Owning a vehicle is a mix of freedom and responsibility.

One important responsibility is paying the Motor Vehicle User’s Charge (MVUC), often called the Road Users’ Tax.

This fee is required during your vehicle’s registration and goes directly toward improving road quality, safety, and transportation infrastructure.

If you’re a vehicle owner, paying the MVUC is part of your annual obligations, with rates depending on the type, weight, and age of your vehicle.

By meeting this obligation, you contribute to better roads and safer travel for everyone.

Why Paying the MVUC Matters

Think of the hassle of being stopped during a traffic inspection and realizing your vehicle registration has expired.

It’s not just inconvenient—it can disrupt your day and result in fines.

Paying the MVUC on time keeps your vehicle registration valid, sparing you from such troubles.

More importantly, the funds collected from the MVUC directly benefit everyone.

They are used for maintaining roads, reducing accidents, and making daily commutes smoother.

It’s your way of helping create safer and better roads for all road users.

What You Need to Prepare Before Payment

Getting your documents ready ahead of time will save you from delays and stress.

Here’s what you’ll need to bring:

- Motor Vehicle Inspection Report (MVIR): Proof that your vehicle passed the required inspection.

- Certificate of Emission Compliance (CEC): Ensures your vehicle meets emission standards.

- Current Certificate of Registration (CR) and Official Receipt (OR): These confirm your vehicle’s existing registration.

- Tax Identification Number (TIN): Necessary for all tax-related transactions.

- Early Warning Device: Often checked during inspections to meet safety standards.

Being well-prepared makes the process smoother and quicker.

How to Pay the MVUC

- Find an LTO Office

Look for the nearest Land Transportation Office (LTO) that handles vehicle registrations.

Double-check their operating hours and any specific requirements.

- Submit Your Documents

Present all the necessary documents at the LTO counter.

The staff will review your documents and calculate the fees based on your vehicle’s specifications.

- Settle the MVUC Fee

Proceed to the cashier to pay your MVUC.

Payments can usually be made using cash, debit, or credit cards.

Keep your official receipt as proof of payment.

- Receive Your Updated Documents

After payment, collect your updated Certificate of Registration (CR), Official Receipt (OR), stickers, and license plates if applicable.

MVUC Rates

The amount you pay for the MVUC depends on your vehicle type, weight, and age.

Here’s a simple breakdown:

Private Vehicles

- Light Passenger Cars (up to 1,600 kg): ₱1,600.00

- Medium Passenger Cars (1,601–2,300 kg): ₱3,600.00

- Heavy Passenger Cars (over 2,301 kg): ₱8,000.00

Motorcycles

- Without Sidecar: ₱240.00

- With Sidecar: ₱300.00

Trucks and Trailers

- 4,501 kg and above: Base rate plus additional fees based on Gross Vehicle Weight (GVW).

For older vehicles or those with special classifications, fees may vary.

It’s best to verify the exact amount with your LTO office.

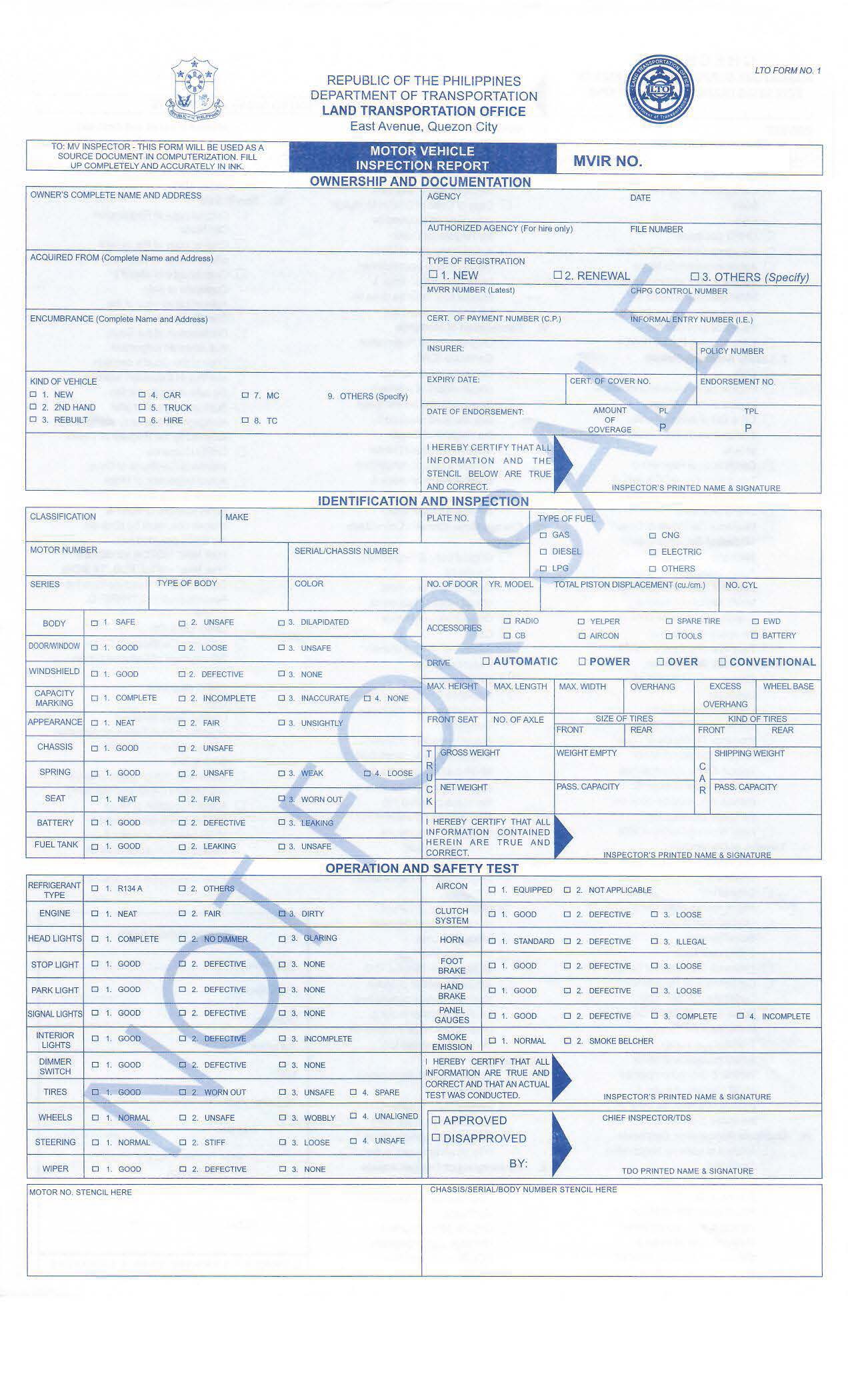

Motor Vehicle Inspection Report Form

This is a document from the LTO that helps determine if a vehicle is ready and safe for the road.

It captures key details like the vehicle’s ownership, classification, and registration type.

The MVIR also includes the results of a thorough inspection, covering parts such as lights, brakes, tires, and emissions.

LTO inspectors fill out this report, marking items as “Approved” or “Disapproved” based on their assessment, to show if a vehicle is road-ready.

This report supports safe travel by allowing only vehicles in good condition to proceed with registration.

Avoiding Penalties for Late Payment

Late payment of your MVUC can lead to additional charges, so it’s best to stay on schedule.

Here’s what you could be charged for delays:

- Beyond Registration Week: ₱200.00

- 1–12 Months Late: 50% of the MVUC rate

- Over 12 Months Late: Full renewal fee, plus 50% of the MVUC rate for each year.

Staying on top of your registration schedule is the simplest way to avoid extra expenses.

Helpful Tips for a Smooth MVUC Payment

- Schedule Early: Process your payment ahead of the deadline to avoid long lines and rush-hour stress.

- Check Your Requirements: Make sure all your documents are complete before heading to the LTO.

- Explore Online Options: Some LTO offices now offer digital pre-processing, which can save time during your visit.

Frequently Asked Questions

- Can I transfer my MVUC payment to a new owner if I sell my vehicle?

No, the MVUC payment is tied to the vehicle, not the owner. The new owner will need to settle the next MVUC during their registration period.

- What happens if I don’t use my vehicle for a year?

Even if your vehicle is unused, the MVUC must still be paid to maintain valid registration.

- Can I use a payment plan for the MVUC?

Currently, the MVUC must be paid in full at the time of registration.

- What happens if my vehicle gets impounded?

Impounded vehicles with unpaid MVUC will need all arrears settled before they can be released.

Final Thoughts

Paying your MVUC isn’t just about fulfilling a legal obligation.

It’s about contributing to a better driving experience for yourself and others.

By settling this fee on time, you avoid unnecessary penalties and help improve the roads we all rely on.

Be proactive.

Prepare your documents, pay your dues, and make sure your vehicle stays roadworthy.

This small step helps create safer and more efficient roads for everyone.

With everything in order, you’ll have peace of mind and a smoother ride ahead.