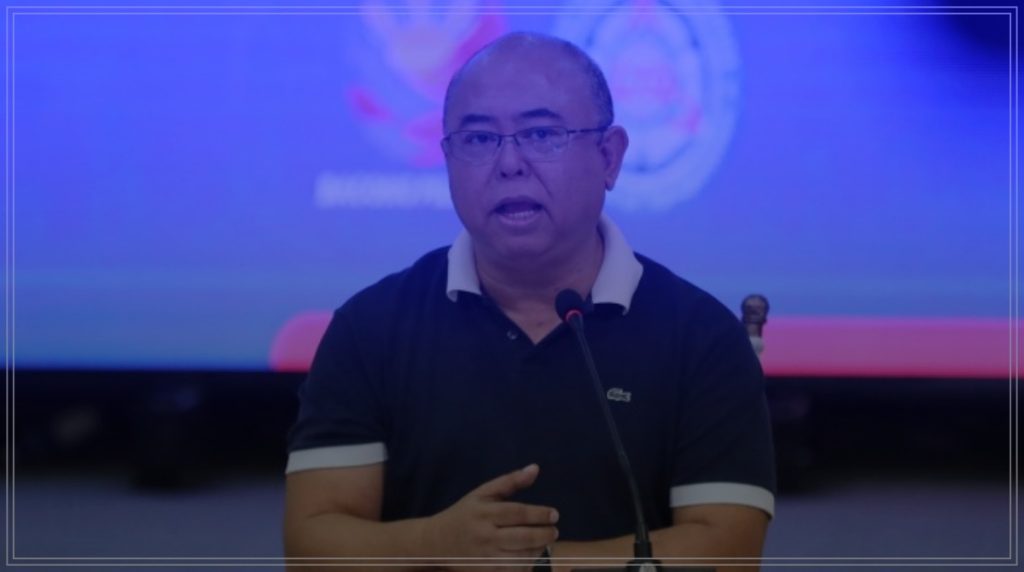

The Land Transportation Office (LTO), in partnership with the Insurance Commission, is pushing for major reforms in motor vehicle insurance policies. LTO Chief Vigor Mendoza II emphasized the need for increased Comprehensive Third Party Liability (CTPL) benefits and a faster claims process to ensure road accident victims receive timely assistance.

This decision gained urgency following a tragic accident on the Katipunan Flyover in Quezon City, which left four people dead and over 20 others injured. Mendoza highlighted how the current insurance system fails to provide adequate and timely relief to victims and their families.

The Problem: Low Benefits, Delayed Payouts

During discussions with Insurance Commissioner Reynaldo Regalado, Mendoza stressed two key concerns:

- Insufficient CTPL payouts – Victims of the Katipunan accident received only ₱200,000, split among all casualties and injured parties. This amount barely covers medical expenses, let alone funeral costs.

- Slow release of insurance claims – Many victims struggle to access financial support when they need it most, as claim processing takes too long.

“Motorists often ignore their CTPL because they believe it’s useless. Many only pay because it’s required for vehicle registration,” Mendoza pointed out.

He stressed that under DOTr Secretary Jaime Bautista’s guidance, LTO aims to restore public trust in motor vehicle insurance by making CTPL benefits both relevant and accessible.

Proposed Reforms: More Coverage, No Added Cost

LTO and the Insurance Commission are exploring ways to increase CTPL benefits without significantly raising premiums. Mendoza assured motorists that reforms would prioritize affordability, ensuring that even ordinary vehicle owners can still comply with insurance requirements.

Pasang Masda President Robert Martin revealed that transport groups had already petitioned the Insurance Commission to raise CTPL payouts last year. Mendoza echoed this demand, emphasizing the urgency of these reforms.

Faster Payouts & Emergency Assistance Hotline

One of LTO’s key proposals is to establish a hotline for insurance-related emergencies, allowing victims and their families to request assistance immediately after an accident.

“Timing is everything in an accident. Immediate financial aid could be the difference between life and death,” Mendoza stressed.

By reviewing existing policies and streamlining claim processing, the LTO hopes to eliminate delays and ensure victims receive the financial support they need—when they need it most.

With these reforms, the agency aims to enhance road safety, rebuild trust in insurance policies, and provide real protection for Filipino motorists and passengers.