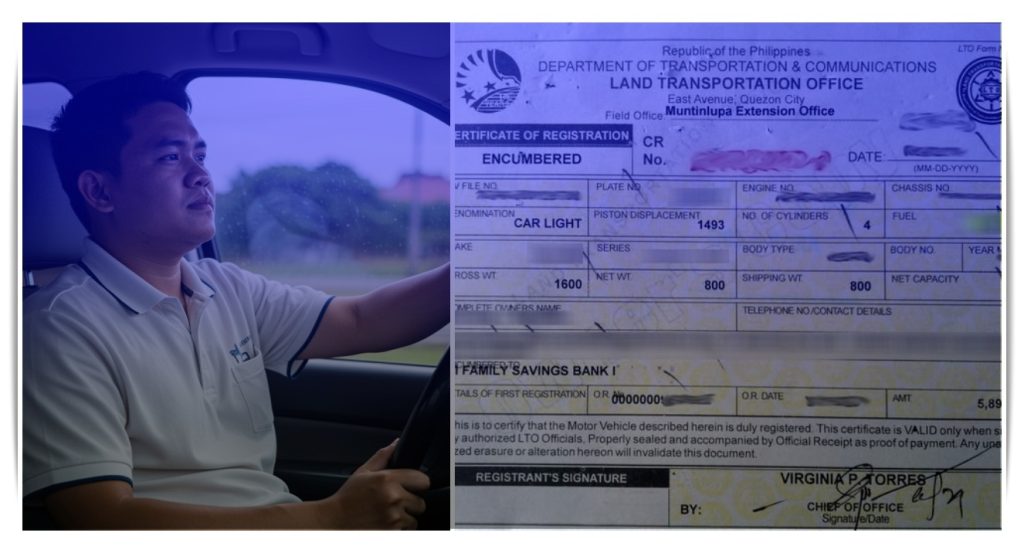

The LTO Certificate of Registration Encumbered (CRE) is a legal document issued by the Land Transportation Office (LTO).

It applies to motor vehicles that are purchased through financing or loans.

If you have taken out a car loan from a bank or a lending institution, this document proves that the vehicle is still encumbered.

This means the lender holds legal ownership until you fully pay off the loan.

The CRE acts as proof that the vehicle is being used as collateral for the loan.

Unlike a regular Certificate of Registration (CR), the CRE includes an annotation on its face indicating the encumbered status.

This document is issued upon registration of the vehicle and remains effective until the chattel mortgage is lifted.

For vehicle owners with outstanding loans, having a CRE is mandatory.

Once the loan is paid in full, you can apply for the cancellation of the mortgage, and the CRE can be converted into a regular CR.

There are fees involved, both in getting the CRE and in the later cancellation of the encumbrance.

Who Needs an LTO Certificate of Registration Encumbered (CRE)?

If you bought a vehicle through a financing scheme or took out a car loan, you need an LTO Certificate of Registration Encumbered (CRE).

Banks and financing companies require this document as proof that the vehicle is collateral for the loan.

You might be:

- A first-time vehicle owner who opted for installment payments

- A business owner who financed a fleet for operations

- An individual purchasing a pre-owned vehicle with an existing loan balance

The CRE ensures the lender’s security interest in the vehicle is legally recorded.

It is an essential document for both personal and commercial vehicle owners using financing.

Key Features of the LTO Certificate of Registration Encumbered (CRE)

The CRE is different from the regular Certificate of Registration (CR).

Here are its defining features:

- Annotation of Encumbrance: The CRE clearly states that the vehicle is under a chattel mortgage.

- Proof of Collateral: The document shows that the vehicle is being used as collateral for a loan.

- Ownership Rights: While the vehicle is registered in your name, the lender holds legal ownership until the loan is settled.

- Loan Repayment Indicator: The CRE acts as an indicator of an outstanding loan on the vehicle.

If your vehicle has a CRE, it means your financing company has a legal claim on it.

Until you complete the loan payments, you are not the full legal owner.

How to Obtain the LTO Certificate of Registration Encumbered (CRE)

Getting the CRE involves coordination between your financing company and the LTO.

Here’s a simplified breakdown of the process:

- Complete the Loan Process

Once your car loan is approved, the financing company or bank arranges the chattel mortgage with the Registry of Deeds. - Prepare the Required Documents

These typically include:- Original copy of your Promissory Note with Chattel Mortgage

- Original copy of the Deed of Sale

- Proof of payment (Official Receipt or OR)

- Confirmation of CR/OR if applicable

- Submit Documents to LTO

The financing company may assist you in submitting these documents to the LTO. - Payment of Fees

You or your financing institution will pay the registration fees, including the annotation of the mortgage. - Issuance of the CRE

After processing, the LTO will issue the Certificate of Registration Encumbered (CRE).

This document will remain annotated until the mortgage is cancelled.

Responsibilities of Vehicle Owners with an LTO CRE

Having a CRE carries specific responsibilities:

- Maintain Timely Loan Payments

Ensure that you are up-to-date with your loan payments.

Missing payments could lead to repossession since the vehicle is collateral. - Secure Lender Consent Before Selling

You cannot sell the vehicle without the lender’s consent.

A written approval is necessary, and you may need to settle the loan first. - Update Registration Annually

Like any other vehicle, those with CREs need annual registration renewals.

Always bring your Official Receipt (OR) and the CRE when renewing. - Observe Legal Compliance

Ensure you meet all legal obligations, including proper documentation and adherence to the terms of your loan.

How to Cancel the Encumbrance on the CRE

Once you fully repay your car loan, you can cancel the encumbrance.

Here’s how you can do it:

- Secure a Release of Chattel Mortgage

Obtain this from your financing company.

It certifies that you’ve paid the loan in full. - Prepare the Necessary Documents

Gather the following:- Original Certificate of Registration Encumbered (CRE)

- Original Official Receipt (OR)

- Release of Chattel Mortgage (original and photocopy)

- Affidavit of Cancellation (if applicable)

- Valid ID

- Visit the LTO District Office

Head to the LTO District Office where the vehicle was originally registered. - Pay the Cancellation Fee

Settle the cancellation fee as indicated by the LTO. - Wait for Processing and Issuance of CR

After processing, you will receive a new Certificate of Registration (CR) with no encumbrance annotation.

This step restores your full ownership rights over the vehicle.

Common Scenarios Involving the CRE

1. Buying a Pre-Owned Vehicle with an Existing CRE

If you’re planning to buy a second-hand car with a CRE, check the loan status first.

Make sure the loan has been paid, or be ready to settle it yourself.

2. Selling a Vehicle with an Active CRE

You need the lender’s written approval.

Often, buyers prefer vehicles with no encumbrance, so clearing the loan first is advisable.

3. Lost CRE Document

File an Affidavit of Loss and request a replacement from the LTO.

You’ll also need to provide valid identification and supporting documents.

4. Transferring Ownership After Loan Repayment

Once you cancel the encumbrance, you can transfer the vehicle’s ownership to another person.

Prepare a Deed of Sale and process it at the LTO along with the new owner.

Frequently Asked Questions (FAQs)

1. Is there a fee for the cancellation of the encumbrance on the CRE?

Yes.

The fee depends on the LTO’s updated schedule of charges.

Additional costs may include notarization and documentary stamps.

2. How long does it take to process the cancellation of an encumbrance?

Processing time varies by LTO branch.

On average, it can take one to three business days once all documents are complete.

3. Can I renew my registration if my vehicle has an active CRE?

Yes.

Having a CRE does not affect your ability to renew your vehicle registration annually.

4. What happens if I fail to cancel the encumbrance after paying off my loan?

The annotation remains in the LTO records.

This could complicate future ownership transfers or sales of the vehicle.

You must process the cancellation to remove the lender’s legal claim.

Conclusion

The LTO Certificate of Registration Encumbered (CRE) is more than just paperwork.

It’s a legal document that outlines the rights and responsibilities between the lender and the borrower.

If you’re financing a vehicle, understanding the CRE is essential.

It ensures you stay informed, compliant, and ready to secure full ownership once your loan is paid off.

By knowing the process—from obtaining the CRE to cancelling the encumbrance—you’re better equipped to manage your vehicle’s legal status.

Whether you’re a first-time car owner or managing a fleet for your business, keeping your CRE in order makes everything smoother in the long run.

And remember: full ownership isn’t just a dream—it’s a process you can complete with the right steps and information.