Compulsory Third-Party Liability (CTPL) insurance is a mandatory requirement for all vehicle owners in the Philippines.

It provides financial protection in case of accidents that result in injury or death to third parties.

CTPL is a prerequisite for vehicle registration with the Land Transportation Office (LTO).

The standard coverage offers up to PHP 100,000 in benefits. It is an affordable policy with fixed premiums based on vehicle type.

While CTPL is essential, it does not cover damages to the insured vehicle, personal injuries to the driver, or theft-related incidents. For broader protection, vehicle owners may consider comprehensive car insurance, which offers additional coverage.

Why CTPL Insurance is Required

The primary purpose of CTPL insurance is to ensure financial support for accident victims. Under Republic Act 10607 (Insurance Code of the Philippines), all motor vehicles must have valid CTPL insurance before they can be registered or renewed with the LTO. This law helps promote road safety and protects third parties from financial burdens caused by vehicular accidents.

Failure to secure CTPL insurance can result in penalties, denial of vehicle registration, and legal consequences for vehicle owners.

CTPL Coverage: What’s Included and What’s Not

What CTPL Covers:

- Medical expenses for third parties involved in an accident

- Death benefits for victims’ families

- Funeral expenses for third parties injured or killed in a vehicular accident

What CTPL Does Not Cover:

- Damage to the insured vehicle

- Injuries sustained by the vehicle owner or driver

- Theft, fire, or vandalism

- Damage to third-party property (e.g., buildings, vehicles)

To cover personal injuries, property damage, and theft, motorists may opt for comprehensive car insurance, which offers a wider range of protection.

CTPL vs. Comprehensive Car Insurance

| Feature | CTPL Insurance | Comprehensive Car Insurance |

| Coverage | Third-party injuries/death | Own damage, third-party liability, theft, acts of nature |

| Mandatory? | Yes | No |

| Vehicle Repair Coverage? | No | Yes |

| Personal Injury Protection? | No | Yes |

| Cost | Affordable (PHP 296 – PHP 1,496) | Higher but customizable based on coverage |

CTPL is required by law, while comprehensive car insurance is optional but highly recommended for full protection.

How to Apply for CTPL Insurance

Applying for CTPL insurance is straightforward. Here’s what you need to do:

- Prepare the necessary documents:

- Certificate of Registration (CR) and Official Receipt (OR)

- Driver’s license

- Another government-issued ID (for verification)

- Choose an LTO-accredited insurance provider:

- Ensure the provider is registered with the Insurance Commission to avoid scams.

- Pay the premium:

- CTPL premiums range from PHP 296 to PHP 1,496, depending on vehicle type.

- Payment can be made via credit/debit card, bank transfer, or e-wallets.

- Receive your Certificate of Cover (COC):

- This document serves as proof of your CTPL policy.

- Keep a copy for your LTO registration.

Application Fees and Payment Methods

CTPL insurance premiums vary based on the type of vehicle. Below are the standard costs:

| Vehicle Type | Premium (PHP) |

| Private Car | 606.00 |

| Light/Medium Trucks | 656.00 |

| Heavy Trucks & Buses | 1,246.00 |

| AC & Tourist Cars | 786.00 |

| Taxi & Mini Buses | 1,146.00 |

| Motorcycles & Tricycles | 296.00 |

Payments can be made through bank transfer, online wallets, credit cards, or LTO payment centers.

How to Claim CTPL Insurance

In case of an accident, follow these steps to file a claim:

- Report the accident immediately to your insurance provider and the nearest police station.

- Secure the necessary documents:

- Police report

- Medical certificate (if injuries are involved)

- Death certificate (for fatal accidents)

- Insurance policy and COC copy

- Submit the documents to your insurer for verification.

- Receive financial compensation once the claim is processed and approved.

Processing times depend on the insurer, but claims are typically settled within two to four weeks.

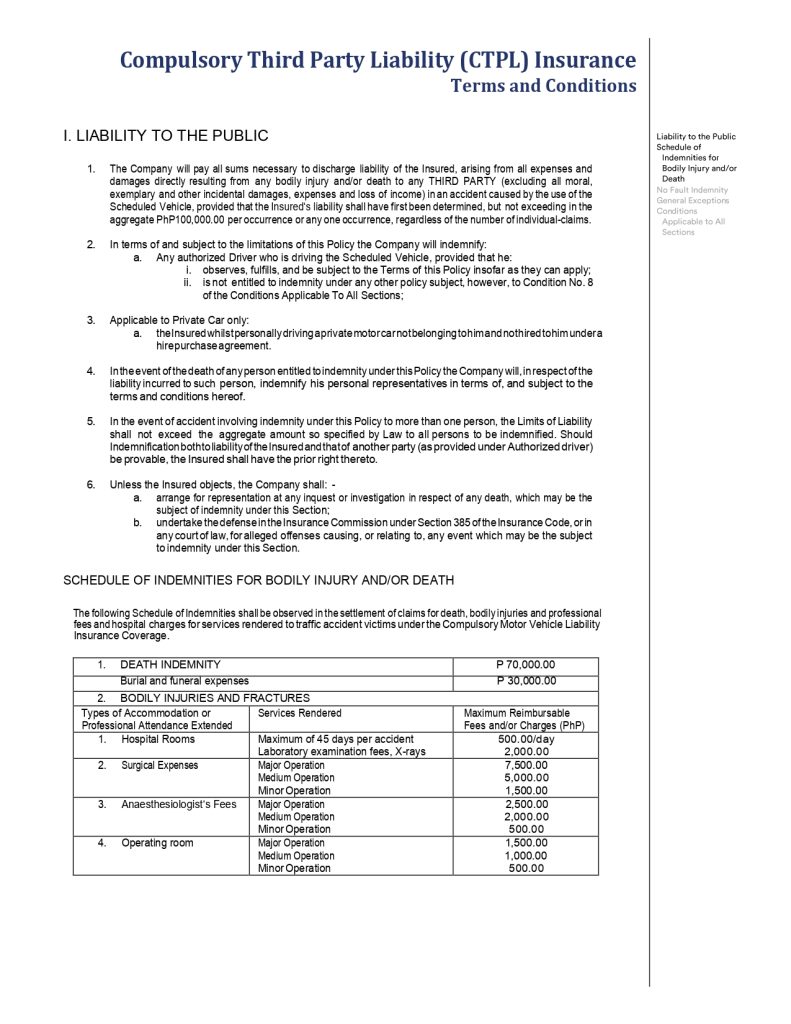

Sample CTPL from BDO Insure

This is the official BDO Insure CTPL, which can be downloaded from BDO’s official website. It serves as a formal document for securing CTPL insurance through BDO Insure, allowing applicants to provide essential details about their vehicle and personal information.

Before getting a CTPL, applicants should ensure they have all required documents, such as their Certificate of Registration (CR), Official Receipt (OR), and a valid government-issued ID. Once completed, applicants should submit all the requirements to BDO Insure along with the corresponding payment. After approval, the Certificate of Cover (COC) will be issued, which must be presented to the LTO for vehicle registration.

Common Misconceptions About CTPL Insurance

- CTPL covers all accident-related costs.

- False. CTPL only covers third-party injuries and death, not property damage or personal injury.

- You don’t need comprehensive insurance if you have CTPL.

- False. CTPL is a basic requirement, but comprehensive insurance is necessary for full protection.

- CTPL claims are difficult to process.

- False. As long as you submit the required documents, claims are processed smoothly.

- Any insurance provider can issue CTPL policies.

- False. Only LTO-accredited and Insurance Commission-licensed providers can issue valid CTPL insurance.

Recent Updates

LTO Pushes for Increased CTPL Benefits and Immediate Assistance

The Land Transportation Office (LTO), in close coordination with the Insurance Commission, is advocating for aggressive policy reforms on motor vehicle insurance, particularly Comprehensive Third Party Liability (CTPL).

LTO Chief, Assistant Secretary Atty. Vigor D. Mendoza II, highlighted the urgency of these reforms during a recent dialogue with Insurance Commission head Atty. Reynaldo Regalado, especially after the tragic truck incident at the Katipunan Flyover in Quezon City last month that resulted in four fatalities and over 20 injuries.

During the meeting, Asec Mendoza emphasized the need to increase CTPL benefits and address the long delays in insurance claim releases. He noted that many motorists view CTPL as useless, as it is often taken for granted and only paid for as a requirement for vehicle registration and renewal.

Asec Mendoza revealed that two key issues were discussed: increasing benefits for motor vehicle accidents and ensuring timely release of insurance payments. He stressed the importance of immediate assistance from insurance providers in the event of accidents, as it can significantly impact the victims’ ability to receive prompt medical care.

The LTO is also exploring the establishment of a hotline for motorists to call for insurance-related concerns during accidents. Asec Mendoza commended Sterling Insurance for their prompt release of P200,000 to the owner of the truck involved in the Katipunan Flyover accident and urged other insurance providers to follow suit.

LTO Proposes CTPL Reform to Ease Vehicle Owners’ Burden

Land Transportation Office Chief Vigor Mendoza advocates for removing the Compulsory Third Party Liability (CTPL) insurance for vehicles with comprehensive coverage.

This move aims to reduce expenses for vehicle owners.

Mendoza plans to coordinate with the Insurance Commission to address long-standing issues faced by car owners.

He also seeks to discuss the prompt release of insurance claims for vehicles involved in accidents.

This reform is part of the LTO’s broader effort to improve motor vehicle insurance policies for the benefit of all motorists.

Video: CTPL – Third Party Liability Insurance Philippines

The video discusses the convenience and affordability of getting Third Party Liability Insurance (TPL) in the Philippines. It highlights the ease of obtaining the policy online, the low premiums for different vehicle types, the quick issuance of insurance policies, and the simple process involving sending necessary documents and proof of payment.

Conclusion

CTPL insurance is a crucial requirement for all vehicle owners in the Philippines. It ensures that third parties involved in an accident receive financial assistance for medical expenses or funeral costs. While it is an affordable and mandatory policy, its coverage is limited. To fully protect yourself, your vehicle, and your passengers, consider investing in comprehensive car insurance alongside CTPL.

Understanding your insurance options empowers you to make informed decisions, ensuring both compliance with the law and financial security on the road. By staying insured, you contribute to road safety and responsible driving while safeguarding yourself and others from unforeseen accidents.

Frequently Asked Questions (FAQs)

1. Can I buy CTPL insurance online?

Yes. Many LTO-accredited insurance providers offer online application and payment options.

2. What happens if I drive without CTPL insurance?

Driving without CTPL can result in penalties, fines, and inability to renew your vehicle registration.

3. Is CTPL transferable if I sell my vehicle?

No. The new owner must secure a new CTPL policy under their name.

4. How often do I need to renew my CTPL insurance?

CTPL is valid for one year and must be renewed annually before your vehicle registration expires.