Purchasing a car can be overwhelming, but BDO’s Auto Loan makes it easier.

With flexible financing plans, competitive interest rates, and quick approval, BDO provides a streamlined process for getting the car you need, whether it’s new or pre-owned.

What is the BDO Auto Loan?

The BDO Auto Loan is a financial product designed to help individuals and businesses purchase brand-new or pre-owned vehicles.

The loan can be used for both personal and business-related car purchases.

It’s also ideal for those looking to purchase hybrid-electric and electric vehicles, aligning with the growing trend of eco-friendly car options.

With BDO, you get access to flexible loan terms and competitive interest rates, making it easier to manage your car loan payments.

This service is ideal for those who are financially ready for an auto loan but would prefer to break the cost into manageable payments over time.

Key Benefits

1. Flexible Financing Options

BDO understands that every car buyer’s financial situation is unique.

This is why the bank offers a variety of financing options.

You can choose from different down payment plans, loan amounts, and repayment terms based on your financial needs and preferences.

Additionally, for those seeking lighter initial payments, options like low down payments and all-in financing (which covers chattel mortgage fees and the first-year motor insurance premium) are available.

These options allow you to maximize the loan amount while still keeping monthly payments affordable.

2. Affordable Cash-Out

No one likes feeling stretched thin financially.

With BDO, the auto loan is designed to be easy on your wallet.

The bank offers cash-out options that minimize the upfront cost, so you don’t have to dig deep into your savings just to make a purchase.

This makes owning your dream car more accessible, with flexible payment schemes that suit your budget.

3. Competitive Interest Rates

One of the main concerns when taking out a loan is the interest rate.

The good news is, BDO provides competitive rates for their auto loans.

This ensures that you can secure a loan without feeling overwhelmed by high-interest charges.

Not only do you get favorable rates, but you can also expect loan approval within 24 hours, which means you can start shopping for your car sooner rather than later.

Key Points on Loan Interest:

- Brand-New Vehicles:

- Interest rates range from 16.48% to 29.51% per annum.

- Rates depend on the loan amount, term, and your credit profile.

- Pre-Owned Vehicles:

- Interest rates range from 16.39% to 34.93% per annum.

- These higher rates account for the increased risk of financing used cars.

- Loan Terms:

- Loan terms range from 12 to 60 months depending on the vehicle and your financial situation.

- Shorter terms may apply for pre-owned vehicles due to their age and value.

- Minimum Loan Amount:

- The minimum loan amount is ₱100,000.

- Additional Costs:

- Chattel Mortgage Fees: Typically 2-3% of the loan amount, covering processing and notarial fees.

- Insurance: Comprehensive motor insurance is required and can be financed as part of the loan.

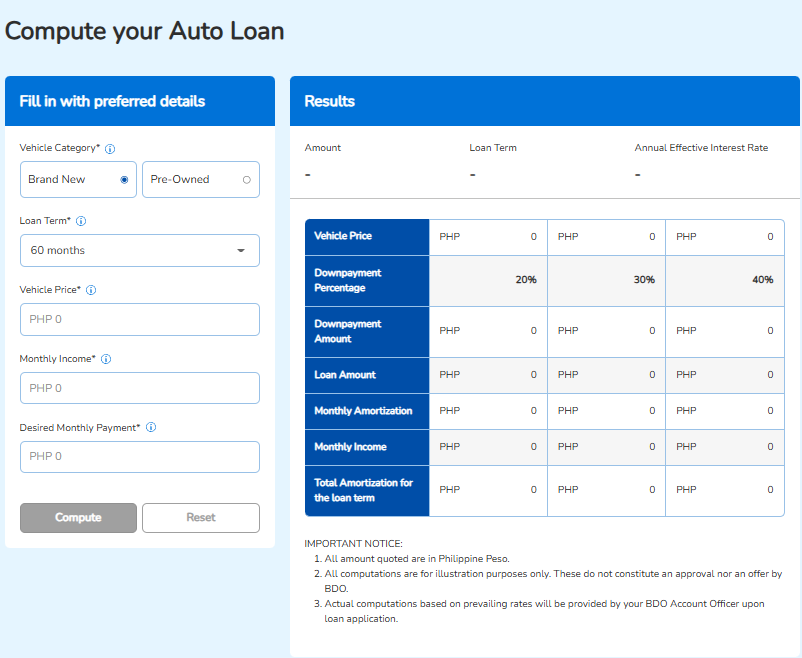

- Tools for Estimation:

- You can use BDO’s Auto Loan Calculator to estimate monthly payments based on the vehicle price, down payment, and loan term.

4. Low Down Payments and All-In Financing

For those who prefer lower initial payments, BDO offers a low down payment option.

This feature is perfect if you’re looking to maximize the loan amount without feeling the pinch on day one.

Moreover, the All-In Financing option is available for those who want the convenience of covering additional fees in one go.

This includes chattel mortgage fees and the first-year motor insurance premium, making it easier to handle your car purchase.

Eligibility

Before applying, it’s essential to ensure that you meet the eligibility criteria.

BDO has clear requirements, so you can assess whether you qualify right away.

1. Age Requirements

Applicants must be at least 21 years old but not exceed 70 years old by the end of the loan term.

This age range ensures that applicants are mature enough to handle the financial responsibility while still having ample time to repay the loan.

2. Income Level

For those applying, it’s necessary to have a minimum gross family income of ₱50,000 per month, or the equivalent in US dollars.

The income requirement ensures that applicants are financially stable enough to manage the monthly payments for the loan term.

3. Stable Source of Income

You must also have a stable source of income.

Locally employed individuals need to have been with their current company for at least two years.

For self-employed individuals, a minimum of two consecutive profitable years of operation is required.

Employed individuals working abroad must have at least two to three years of consecutive employment. If you’re overseas, an assignment of beneficiary as loan administrator will be necessary.

Documents Required for the Application

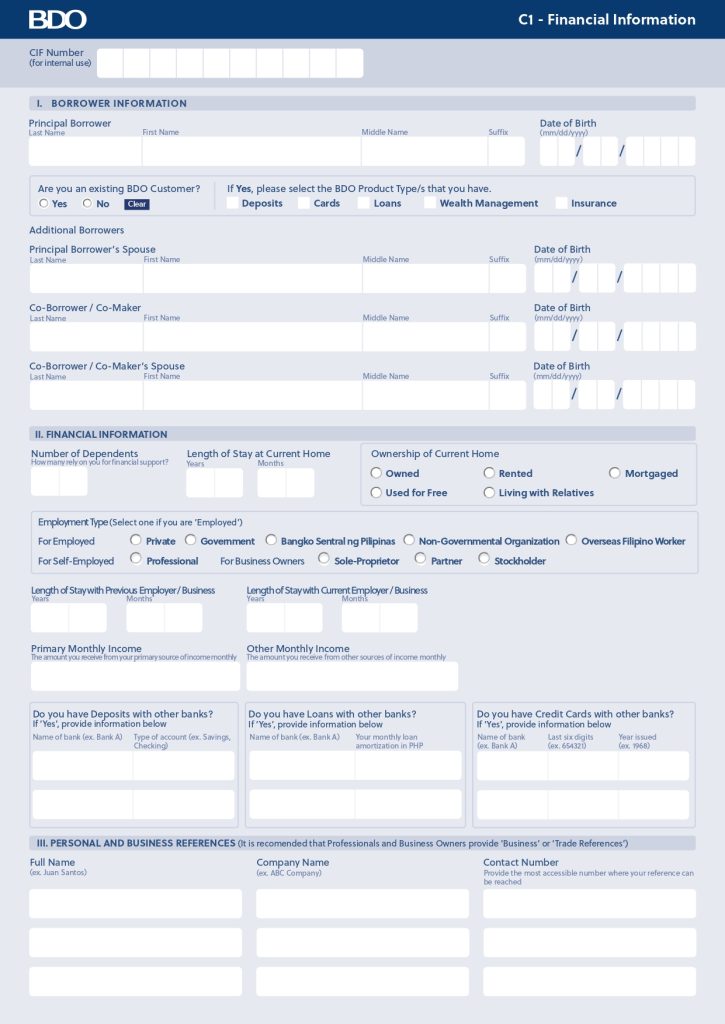

1. Basic Documents

- A completely filled-out application form.

- Identification documents like a driver’s license, passport, or TIN ID.

2. Income Verification

Depending on your employment type, you’ll need one or more of the following documents:

- For locally employed: Latest Income Tax Return (ITR), BIR Form 2316, or your most recent payslip, along with a Certificate of Employment with Salary.

- For self-employed individuals: Audited financial statements for the last two years, the latest ITR, bank statements for the last three months, and a certificate of business registration.

- For overseas Filipino workers: Proof of remittance for the last three months, a crew contract (if sea-based), or consularized Certificate of Employment with Income (COEI) and the latest payslips for the past three months.

Having all the required documents in order will expedite the approval process.

BDO Auto Loan Application Form

The Existing BDO Client Auto Loan Application Form can be downloaded directly from the BDO website.

It is specifically for existing BDO clients looking to apply for an auto loan.

You can use this form to streamline your application process if you already have an existing account with BDO.

Simply fill out the form and submit it along with the required documents for faster processing.

The form is available for download at the following link: Existing BDO Client Auto Loan Application Form.

How to Apply for a BDO Auto Loan Online

Applying for an auto loan from BDO is straightforward and can be done entirely online.

Here’s how you can begin your application from the comfort of your home:

Step 1: Visit the BDO Auto Loan Page

Start by opening your web browser and visiting the BDO Auto Loan page on the official BDO website.

Click on the “Apply Now” button to get started.

Step 2: Fill Out the Application Form

Complete the online application form by entering your personal and employment details.

Provide information like your full name, date of birth, contact details, and monthly income.

Then, indicate the car type (new or pre-owned), loan amount, and loan term you prefer.

Step 3: Upload Required Documents

After completing the form, upload digital copies of your documents.

This includes your valid ID, proof of income, and additional documents as required.

Step 4: Review and Submit

Before submitting your application, double-check that all the details are accurate.

Once confirmed, click the “Submit” button to send your application for review.

Step 5: Wait for Approval

BDO will quickly review your application and notify you about the loan status.

If everything is in order, expect approval within 24 hours.

Step 6: Finalize the Loan

Once your loan is approved, you’ll be asked to sign the loan agreement and submit any additional documents if necessary.

Frequently Asked Questions

1. How quickly can I get my loan approved?

BDO typically processes auto loan applications and provides approval within 24 hours, provided that all necessary documents are submitted correctly.

2. Can I use the loan for a used car?

Yes, BDO Auto Loans are available for both brand-new and pre-owned vehicles.

3. What if I don’t have a credit history?

Even without a credit history, you may still be eligible for a BDO Auto Loan if you meet the other requirements, like income stability and a good employment record.

4. Can I pay off my loan early?

Yes, BDO allows early repayment of the loan. However, it’s advisable to check the terms and conditions for any early repayment fees that may apply.

Video: Ride your way with BDO Auto Loan (3Os)

The video promotes BDO Auto Loan as a solution for individuals pursuing their passions by offering fast application, low rates, and affordable Cash Out options.

Conclusion

A BDO Auto Loan is a great option for individuals and businesses looking for a flexible, affordable way to finance a vehicle purchase.

With low interest rates, flexible payment terms, and fast approval, it’s designed to help you drive away in your new car as soon as possible.

Remember to ensure you meet the eligibility requirements and gather the necessary documents to make the application process smoother. Start your journey to owning your dream car today with BDO’s Auto Loan program!